Popular customer service; (CX) platform designer, Freshworks experienced a solid first quarter. That is, at least according to the recent drop of its latest mixtape. And by mixtape, I mean financial earnings report, something that: "oddly" enough - despite healthy figures and high future projections, caused the firm's stock to dip.

The CX-giant noted that it continues achieving business efficiency, with $1.4 million in gross funds gained from operating activities to show for it. Its net-dollar retention rate also rose to 115%, a figure that rose one percentage point when compared quarter-over-quarter.

Customer service software like the kind Freshworks produces has seen a rise in usage during the Coronavirus Pandemic. It is merely one possible explanation for such growth over the last quarter, though, but there remain a myriad of possibilities this is the case.

What is Freshworks?

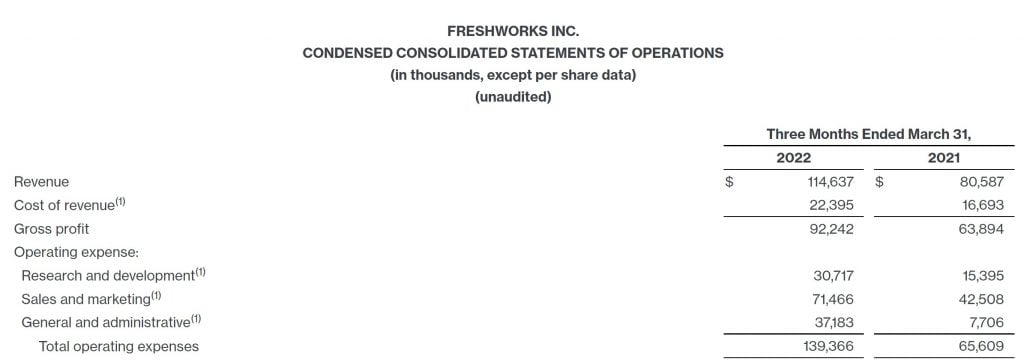

I want to dive deeper into Freshworks and what made this quarter so exemplary for the CX-focused firm. For starters, the company reached $114.6 million in total revenue. Industry analysts had only predicted an adjusted loss of five cents per share, projecting Freshworks would earn revenue of $108.26 million.

Breaking Down Freshworks Q1: By the Numbers

GAAP losses from operations reached $47.1 million, which is drastic when you consider in the first quarter of 2021, that figure was only $1.7 million. Its non-GAAP losses from operations amounted to $0.6 million - the same as in the first quarter of 2021.

According to a statement by the company, its GAAP net loss income per share, which amounts to basic and diluted net (loss) per share: reached $(0.18) based on 278.2 million weighted-average shares outstanding. You can compare these figures to its GAAP basic net income per share and diluted net (loss) per share of $0.89 and $(0.01), based on 77.7 million and 233.4 million weighted-average shares outstanding in the first quarter of 2021.

Its non-GAAP net loss per share reached $(0.01) based on 278.2 million weighted-average shares outstanding, which one could compare to $(0.02) based on 77.7 million weighted-average shares outstanding in the first quarter of 2021.

In terms of net cash raked in by operating activities, that number reached $1.4 million. In the first quarter of 2021, it was $7.8 million. Regarding the firm's free cash flow, that number earned Freshworks $1.4 million, which is less than it made during the first quarter of 2021 when the number reached nearly $5 million.

Freshworks had cash, cash equivalents, and marketable securities that reached (a total of) $1.2 billion as of March 31, 2022.

Steady Customer Growth in Q1 and More

Freshworks further reported that 15,639 of its customers now contribute more than $5,000 in ARR (annual recurring revenue), a 27% year-over-year increase.

Accordingly, the firm's net dollar retention rate reached 115%, compared to 114% in the fourth quarter of 2021; and 112% in Q1 2021. It also welcomed a few new customers to its roster of clients, including California Credit Union, Kuka, Marymount Manhattan College, Sodexo, Ticket Network, Thermo Fisher, etc.

Not only was new business the focus of the previous quarter had by Freshworks, but it further launched Freshworks CRM for e-commerce, what it calls a:

"Solution built for consumer companies that integrates conversational marketing and support."

Partnerships, as with any tech (player): were also front and center of Q1; the customer experience firm announced new partnerships with Shopify, Device42, Good Data, and Yext. It also boasted that it had completed 150 projects with the IT consultancy business - Tata Consultancy Services (TCS). In a statement, Freshworks further said:

"Similar to prior quarters, the average revenue per account continues to increase and contribute to our revenue growth as customers are expanding on our products, as we engage in larger deals. Now, turning to billings and the balance sheet items."

What is Q2/2022 Shaping Up to Become?

As the following are merely projections, they are subject to change, but for now, Freshworks anticipates the following: For the second quarter of 2022, it hopes to see a total revenue between $117.0 million and $119.0 million. Its non-GAAP loss from operations could be as much as $18.5 million or as little as $16.5 million.

For its non-GAAP net loss per share, well, that could reach between $0.08 and $0.06 per share.

Giving guidance for the entirety of the year, Freshworks looks to earn a total revenue between $495.5 million and $501.5 million. Its non-GAAP losses from operations may reach between $43.5 million or go as low as $37.5 million on the lower end.

Finally, its non-GAAP net loss per share could be as much as $0.18 to $0.16 with non-GAAP net losses per share; Freshworks estimates could reach 284.4 million weighted-average shares outstanding for the second quarter, as well as for the full year of 2022.

Loses for Tech Companies, Across the Board

Freshworks is not the only tech company experiencing losses. All across the Valley, several tech giants reported more than $17 billion in losses on equity investments in Q1, according to MSNBC reporting. Amazon, Alphabet, Uber, and Shopify individually have reported billion-plus-dollar losses on investments made during the quarter.

Even companies like Qualcomm, Microsoft, and Oracle experienced hefty losses during Q1 2022. Wireless technology giant Qualcomm; reported a sizable $240 million loss on things like stocks, bonds, and preferred shares, noting in a statement:

"It was primarily driven by a change in the fair value of certain of our QSI marketable equity investments in early or growth-stage companies.”

Qualcomm Strategic Investments, the firm's investment arm, actively gives to what it suspects will be start-ups with innovative new artificial intelligence applications. It has also made several strategic investments in digital health organizations, those in the networking world, and other emerging areas of the tech sphere.

All this (goes to show) that companies in Silicon Valley take plenty of risks when hoping to enhance product portfolios. It comes down to having a lot of savvy, some good luck in selecting companies that can perform and deliver, as well as having the backing of investors with deep pockets.

It also highlights just how much cash actually flows through these companies and how sometimes they may not even feel it when they lose large sums of money. For a long time, it seems that many have speculated that Freshworks could be the next Salesforce. Only time will tell before that will manifest as a reality, but as we have seen in many cases - anything is possible in the world of tech.