Even though this is the case, the CPaaS software giant still said that second-quarter growth would be slow.

The term, which ended on March 31, 2022, includes $32.2 million from Zipwhip, and organic revenue grew by 35% year-over-year. The CPaaS leader experienced a GAAP loss from operations of $217.8 million during the first quarter of 2022, compared with a GAAP loss from operations of $197.3 million for the first quarter of 2021.

Twilio experienced a dip in its non-GAAP income from operations of $5.0 million in the first quarter of 2022. Compare this with the CPaaS firm's non-GAAP income from operations of $17.3 million for the first quarter of 2021.

Accordingly, Twilio bore a GAAP net loss per share, which it attributes to common stockholders, both 'basic' and diluted: at (the rate of) $1.23 based on 180.9 million (weighted) average shares outstanding in the first quarter of 2022. If you compare this with the firm's GAAP net loss per share attributable to common stockholders, basic and diluted, of $1.24 based on 167.2 million weighted average shares outstanding in the first quarter of 2021 - the loss appears minimal.

According to a press release put out by Twilio:

"Twilio's non-GAAP net income per share attributable to common stockholders, diluted, of $0.00 based on 184.5 million non-GAAP weighted average shares outstanding in the first quarter of 2022, compared with non-GAAP net income per share attributable to common stockholders, diluted, of $0.05 based on 180.6 million non-GAAP weighted average shares outstanding in the first quarter of 2021."

All this has implications for the world of CPaaS, most importantly; for Twilio. I'll break down what it all means in the sections that follow.

Examining Twilio's Key Metrics, Guidance

Twilio now has a record-breaking 268,000 active customer accounts as of March 31, 2022. Compare this with a mere 235,000 active customer accounts it reported on March 31, 2021. According to Twilio:

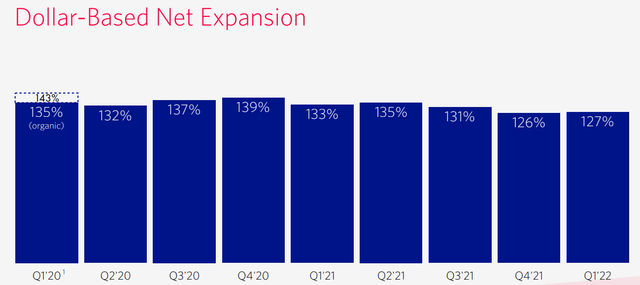

"Dollar-Based Net Expansion Rate was 127% for the first quarter of 2022, compared to 133% for the first quarter of 2021. Results from acquisitions closed after January 1, 2021, including Zipwhip, do not impact the calculation of this metric in either period."

The company's employee count even rose, as of March 31, 2022, it has 8,199 employees. All this is great, but there are still a few issues at hand, according to analysts at Seeking Alpha, who note that:

"While Twilio's organic guidance for Q2 is satisfactory at best - the takeaway is that Q2 2022 will see Twilio's profitability profile turn negative, once more."

The author of the piece, Michael Wiggins De Oliveira, who heads up the Seeking Alpha Investment Newsletter, went on to write: "I can recognize what Twilio is attempting to achieve. But there is no getting around the fact that the more Twilio grows, the less profitable it becomes."

All this has led to low guidance and another round of unsure investors. Where is Twilio stock headed? Will Twilio ever turn a profit? Both questions; remain unanswered, but what is apparent from its Q2 outlook is that there's still work to be done by the firm.

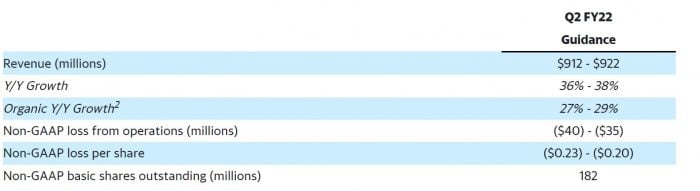

Looking ahead to the forecast period (that ends) on June 30, 2022, Twilio anticipates revenue between $912 and $922 million. Examining year-over-year growth could reach between 36 and 38 percent, with organic year-over-year growth potentially being between 27 and 29 percent; growth.

Non-GAAP income loss from operations might reach as much as $35 to $40 million, with non-GAAP losses per share: reaching between ($0.20) and ($0.23). Finally, Twilio's non-GAAP basic shares outstanding could reach 182 million; it wrote in a statement.

SEC Files Charges Against Twilo Engineers

Occurring between: March and May 2020, CNBC notes, as cloud tools were gaining use due to the surge in remote work: "Twilio engineers Lokesh Lagudu, Chotu Pulagam, and Hari Sure accessed financial information from the company’s databases," CNBC wrote.

They did so via a private chat group, sharing the information with others who then made trades before Twilio announced its first-quarter results back in May 2020, according to a filing by the U.S. District Court, in the Northern District of California.

The three engineers shared the information with friends and family, prompting the U.S. Securities and Exchange Commission to charge the trio with insider trading; as the group raked in over one million bucks in profit, the official SEC filing noted.

This has all come to light in recent months, and it has undoubtedly caused some investors to become weary of the firm that continually struggles to turn a profit. Nonetheless, Twilio continues updating its leadership in hopes of more favorable metrics due to more solid leadership skills.

Shaking Up its Executive Team

Effective May 4, 2022, Elena Donio became Twilio’s President of Revenue, hoping to beef up its efforts on that front. She has assumed responsibilities for the firm's go-to-market efforts which is sure to be no small feat. She resigned from her position on Twilio’s Board of Directors before landing her new gig - and previously served in several leadership roles in (the world of) tech - for the past 25 years.

Twilio Valuation Measurements Yahoo! Finance

Donio acted as the CEO of Axiom and as President of SAP Concur. There she oversaw growth and profitability for the entire business. She wrote in a statement that she was excited about her new role, continuing:

"I couldn’t be more excited to join Twilio to help accelerate our journey to become the leading customer engagement platform. Having built my career around enterprise sales, marketing leadership, and product innovation, and with a deep understanding of Twilio’s business, team, and culture from my six years on Twilio’s Board of Directors."

The decision comes just a short time after Marc Boroditsky, Twilio’s previous Chief Revenue Officer, said he would step down from his position, effective immediately. He will, however, stay on for a short time in an advisory role. Only time will tell if Donio has what it takes to make Twilio turn a profit.

It will most certainly be a wild ride for the firm's newest asset to attempt to lead the CPaaS giant to profitability but not an impossible one if she can help all sectors align their ducks. Somehow, Twilio remains an investment favorite and I'm sure Donio hopes to retain that confidence that some of its largest shareholders have in the firm.