Unified Communications as a Service (UCaaS) software increases team collaboration, prevents communication silos, and enables real-time employee interactions across channels, locations, and devices. 2023 brought advanced task management features, high-level integrations/APIs, and remote-friendly capabilities like live file co-editing to the UCaaS space.

But what’s next?

Below, we’ve outlined the top 5 UCaaS trends for 2024.

1. Single-Vendor UCaaS and CCaaS

In 2023, cloud communications providers began to explore including a ready-made unified communications suite as a part of their contact center software.

In 2024, the union between UCaaS and CCaaS will become more official, as unified communications providers expand their product offerings to include scalable contact center solutions.

Nearly 70% of enterprise-level IT leaders express an interest in purchasing a unified UCaaS/CCaaS software, citing significant cost savings, customizable communications, and a better customer experience as motivating factors.

8x8, RingCentral, Zoom, Dialpad, and Nextixa now all offer omnichannel contact center software in addition to their core unified communications tools. Even helpdesk software like Freshdesk has entered the unified UCaaS/CCaaS space with their Freshworks Customer Service Suite.

This new competition may lead standalone CCaaS providers like Genesys, NICE, and Talkdesk to develop stronger unified communications products–with a focus on industry-specific integrations–to maintain their space in an increasingly crowded market.

2. Employee Engagement via UCaaS

Historically, Employee Engagement and Experience (EX) has been a task for Workforce Management and Workforce Optimization software. While some contact centers also include EX features like a shared omnichannel inbox or performance gamification, optimizing the employee experience has long felt like an afterthought in the SaaS space.

In 2024, expect to see more and more UCaaS providers making employee engagement tools a central part of their product offering–and taking them to new heights.

Led by Zoom’s acquisition of Workvivo and Microsoft Viva for Teams, UC providers are creating a mobile-first, social media-like employee experience dashboard designed to boost employee recognition, interaction, and ultimately retention.

Employees can customize their daily “news feeds,” follow each other, and create, like, comment, and share posts. They can upload photos and videos, vote in polls, view or record live streams, record and share podcasts, create committees and after-work clubs, and even review assigned training modules or performance scoresheets.

In addition to company-wide updates, admins can post training materials and course catalogs, knowledge bases, campaign/marketing updates, and award badges. These EX apps also have file sharing/storage, chat functionality, and engagement analytics.

3. Generative AI

If 2023 was the year of IVAs, chatbots, and AI-powered analytics, then 2024 is the year of Generative AI.

In 2023, Generative AI was best known for quickly crafting blog posts and convincing images. In 2024, expect to see its capabilities applied to business communication software on a massive scale. Generative AI has a variety of use cases in the UCaaS space, including:

- Automated post-meeting summaries with suggested tasks/action items, highlight reels, post-meeting/live transcripts with speaker differentiation and multi-lingual translation

- Clarifying internal communication (emails, business memos, project specs, etc.) with real-time syncing across channels

- Real-time agent call scripts or canned responses pulled from integrated knowledge bases/wikis

- Automated report generation powered by predictive analytics for agent schedule optimization/trend forecasting

- Project and task management/automation

- Agent training, onboarding, real-time coaching, performance reviews

- Compliance/security automation

4.UCaaS For Hybrid Work Environments

After a years-long focus on developing and optimizing cloud software for fully remote teams, expect the UCaaS space to cater heavily to hybrid workplaces in 2024.

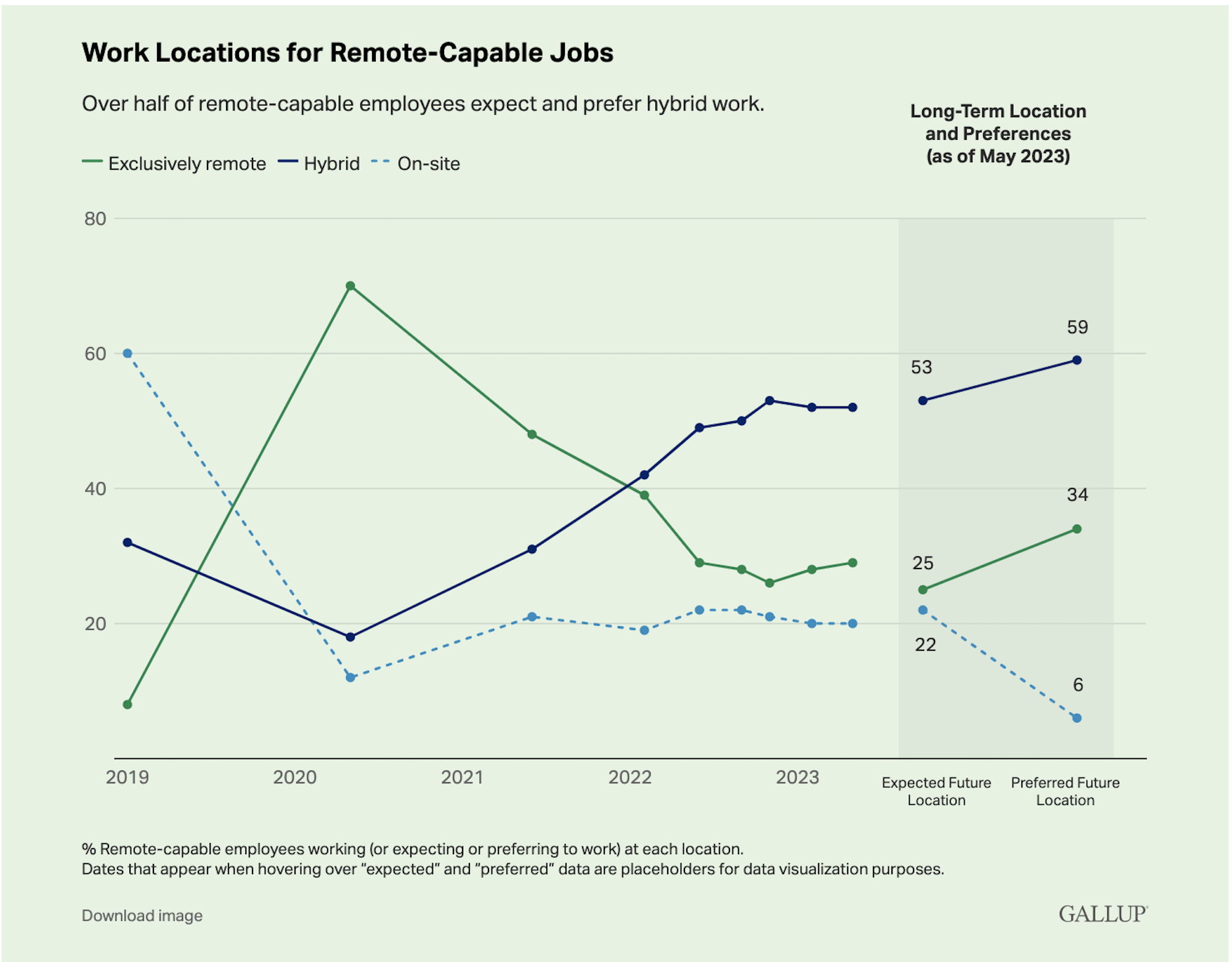

Hybrid work has consistently grown in popularity since the downturn of the COVID-19 pandemic in mid-2021. A Gallup poll shows that while in 2020, 70% of employees preferred to work fully remote, by mid-2023, just 29% of employees said they’d prefer an entirely remote job. Additionally, while only 18% of employees in 2020 preferred a hybrid environment, by mid-2023 52% of employees preferred a hybrid workspace.

(Image Source: Gallup)

As a result, 2024 is expected to be the year of hybrid events–including industry-specific conferences, standard weekly meetings, employee training/continuing education, and even sales conventions.

To cater to this rise in hybrid events, most UCaaS software now includes webinar/online event capabilities, not just basic video conferencing tools. For example, in mid-2023 RingCentral acquired Hopin Events, an event management and engagement platform with multi-session events, AI-powered event marketing, and customizable virtual venues.

Look for UC software with included or add-on webinar features like interactive presentations, virtual networking, higher participant limits, and digital conventions with customizable booths.

5. Hardware Optimizes UC and Team Collaboration

Although the boost in hybrid work means more team members will spend part of their workweek in-office, 2024 is the final nail in the coffin of premise-based communication solutions and their bulky, expensive hardware.

This year is the “last chance” for businesses to make a smooth transition to cloud-based (hosted) UCaaS and CCaaS solutions–before the PSTN is entirely switched off in December 2025.

Outdated desk phones with tiny LCD screens will be replaced by customizable meeting room hardware like digital signage, standing interactive whiteboards, and check-in kiosks with room reservation capabilities.

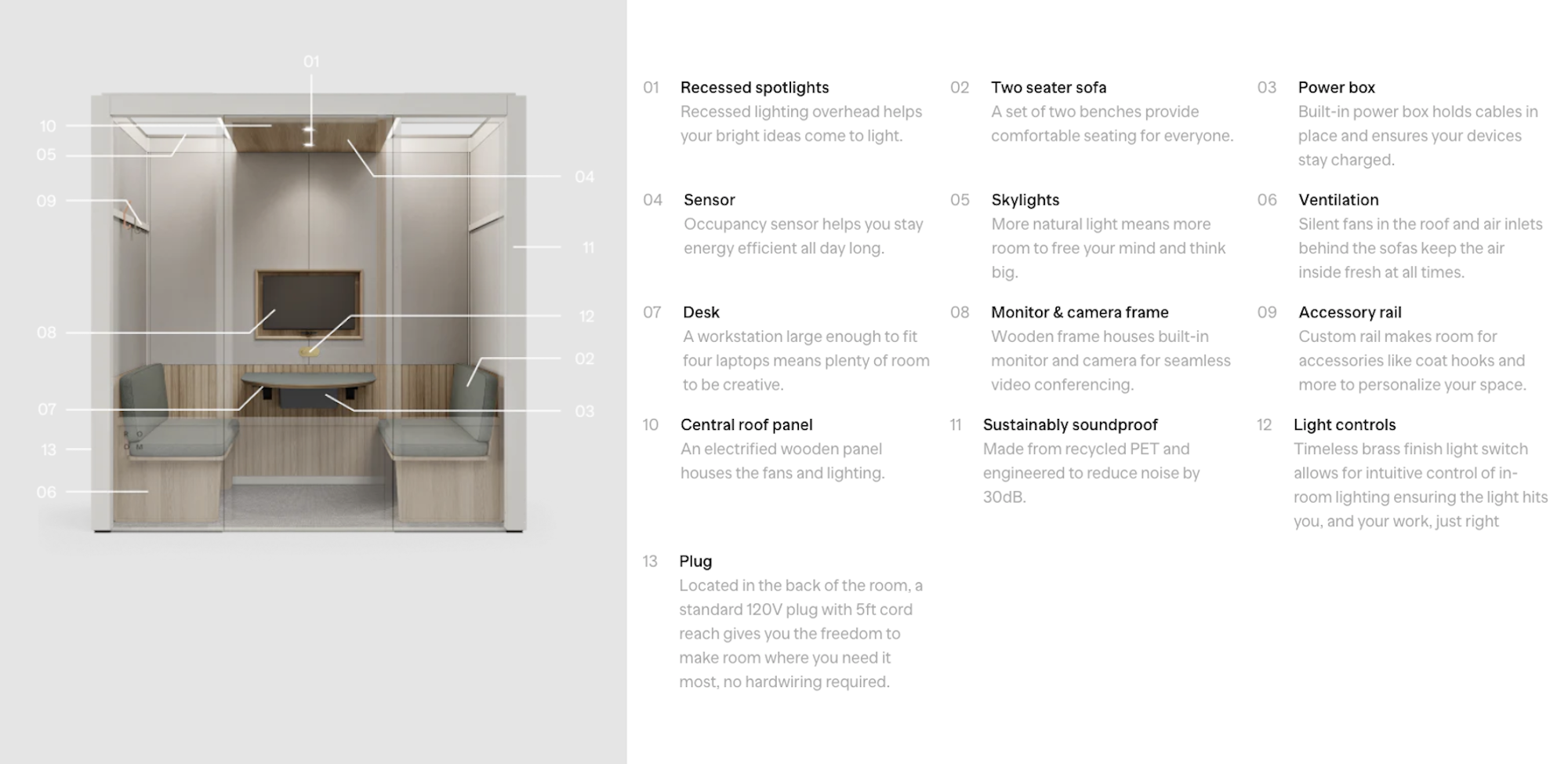

Zoom’s Hardware as a Service for Zoom Rooms lets you completely customize your conference space, while newcomers like Room offer pre-fab conference rooms that integrate with UCaaS platforms like GoTo Meeting, Microsoft Teams, Zoom, and Slack.

UCaaS 2024: Engaging the Hybrid Workforce

2024 UCaaS trends like employee engagement features, customizable meeting hardware, and generative AI all have one thing in common: they cater to the needs of an increasingly hybrid workforce.

Unified Communications providers will continue to power with top CCaaS platforms–or create their own contact center product–to streamline business applications and day-to-day workflows.

As always, our team at GetVoIP will continue to deliver the SaaS reviews, product guides, and industry updates you need to stay ahead of the curve.