Provider Overview

Based in Ontario, Canada and with 45 years of experience in business communications, Mitel offers an impressive portfolio of cloud-based solutions available around the world. Ranked as #1 in UC Market Share in Europe and #2 in UCaaS Market Share Worldwide, Mitel powers more than two billion business connections in nearly 100 countries with our cloud, enterprise, and next-gen applications.

Throughout our 45 years of industry leadership, innovation has been core to Mitel’s DNA – helping to continuously evolve to meet customer needs and drive the industry forward. That passion has led to significant company growth and ongoing recognition of their solutions by industry experts.

Today, Mitel is a global market leader in business communications, powering more than two billion business connections with their cloud, enterprise, and next-gen collaboration applications. With more than 70 million users in nearly 100 countries, Mitel is the only company that wakes up every day exclusively focused on helping customers take their communications from where they are today to where they expect them to be.

Mitel Solutions and Features

No matter if you have a small, mid-size or enterprise business, Mitel offers a variety of platforms in Unified Communications, VoIP, Contact Center, Collaboration, Cloud Communications, Mobility, Unified Messaging, Virtualization and UCaaS, in order to find the best fit for your company in a variety of locations around the world.

MiCloud Connect

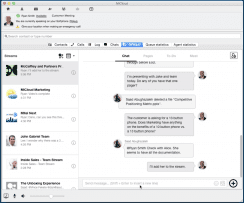

- Support for hybrid/remote working, cross-platform chat (Teamwork)

- Secure and flexible cloud phone services and unified communications

- Collaboration features to enhance productivity

- Robust remote working support

- Enhanced customer experience tools

- Global reach

- Enterprise-grade VoIP phone service

- Instant messaging – cross-platform (Desktop, Mobile)

- Audio and Web Conferencing

- Multi-point Video

- Global Numbers available

- Mitel Connect Contact Center

- Enterprise-class Security

- Disaster recovery service and emergency notifications

- Improved business intelligence with integrations

- Salesforce

- MS Teams

- NetSuite

- Chrome

- Reach out for full list of integrations

- Self-Service for organizations under 25 seats (own your onboarding timeline)

MiCloud Flex

- Unified, Mission-critical private cloud communications solution

- Designed for enterprises of all sizes

- Hosted Unified Communications as a Service

- Real-time video conferencing and collaboration

- Integrated advanced omnichannel contact center

- Integrations and customization with business tools

- Single communications portal available on desktop or mobile devices

- Voice, email, text, and chat from any device

- Local number portability

- Direct inward dialing

- Flexible SIP bundles

- Unified Messaging

- Multi auto attendant

- Advanced conferencing and collaboration tools

- Hybrid network solutions

- Mitel survivable gateways with local PRI bundles

- Instant messaging

- Teleworker support

- Dual mode handoff

- Single number reach

- Full control over updates and maintenance

Mitel Onsite Solutions

If your organization is looking for a premise-based phone system, Mitel offers a variety of onsite solutions:

- MiVoice Business

- MiVoice Connect

- MiVoice Office 400

- MiVoice Border Gateway

- MiVoice 5000

- MiVoice MX-On

Learn about Mitel’s Onsite Solutions Here.

Editor's Bottom Line of Mitel

Mitel offers cloud solutions for different sizes of businesses. Mitel’s MiCloud Connect, designed as a secure and flexible UCaaS (Unified Communications as a Service) solution, is a strong offering for small and mid-sized businesses (SMB) that are looking to transition from an on-premise or landline solution to a completely cloud-based platform. MiCloud Connect provides organizations with more than just Business VoIP, but also advanced collaboration features including web conferencing and instant messaging.

Mitel’s MiCloud Flex solution is designed for larger enterprise organizations that have a strong need for mission-critical communications. The MiCloud Flex platform extends beyond basic UC (Unified Communications) and adds even more advanced functionality like local number portability, direct inward dialing, flexible SIP bundles and even video conferencing. This platform can also be directly integrated with Mitel’s contact center solution, as well as hybrid network solutions. MiCloud Flex lives up to its name, and truly provides the flexibility and stability that a large-scale enterprise requires to keep the lights on and business running as usual.

Mitel is constantly listening to customers’ feedback and evolving their solutions to fit into those specific needs. With the flexibility provided by a cloud-based solution, any organization can find the right platform that will satisfy collaboration needs while remaining cost effective, and almost infinitely scalable. Mitel has routinely been recognized as a leading provider in the Unified Communications market, both domestically and globally.

In 2020, Mitel was recognized with the Remote Tech Breakthrough Awards.